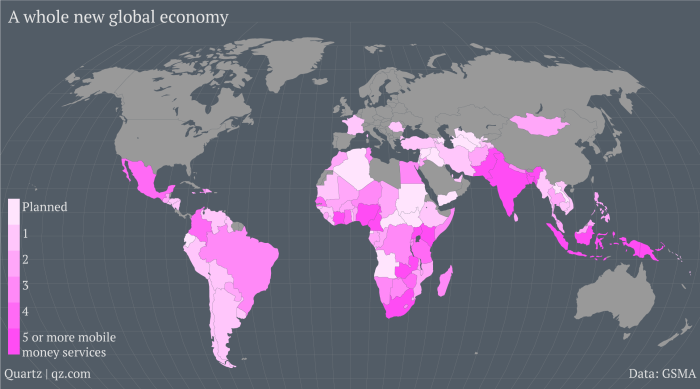

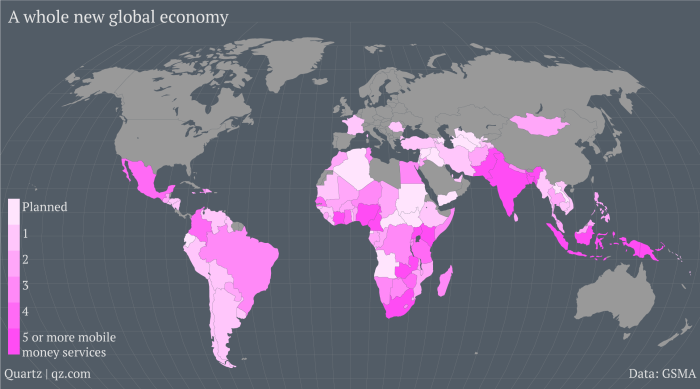

Via @prepaid_africa, this graph on the prevalence of mobile money: I suspect the main reasons are “least regulation” and “least powerful/developed existing banking establishment”, but these are speculative. Anyone know the answer?

I suspect the main reasons are “least regulation” and “least powerful/developed existing banking establishment”, but these are speculative. Anyone know the answer?

Via @prepaid_africa, this graph on the prevalence of mobile money: I suspect the main reasons are “least regulation” and “least powerful/developed existing banking establishment”, but these are speculative. Anyone know the answer?

I suspect the main reasons are “least regulation” and “least powerful/developed existing banking establishment”, but these are speculative. Anyone know the answer?

52 Responses

RT @FrontlineSMS: Why is mobile money so prevalent in Africa? Via @cblatts http://t.co/Et3EXHxgqu cc @fsmscredit

RT @FrontlineSMS: Why is mobile money so prevalent in Africa? Via @cblatts http://t.co/Et3EXHxgqu cc @fsmscredit

Interesting question, with presumably many contributing components to the answer, as it made clear by many commenters. Also made me think about why “the West” appears to resist the adoption of this proven technology (except France?). Is the West seeing this as something from “Africa”, not for us? Do such notions even come into play when considering diffusion theory. Probably. I’d be interested to see if expats in big mPesa countries like Kenya and Tanzania use it to the same extent as Kenyans and Tanzanians.

Your graph looks at supply rather than demand. Not surprising that India has 5 or more but as you know this doesn’t match take up which is far ahead in East Africa. An underdiscussed reason for this is that on the demand side, social relations are a critical feature. One of the reasons for the rapid spread in Kenya and likely also in other parts of East Africa is that people do a lot of gifting and borrowing among relatives and friends – mobile money makes this very easy, enables social networks and consolidates friendship. See http://www.bath.ac.uk/cds/publications/bpd30.pdf and http://www.fsdkenya.org/insights/14-04-23_FSD_Insights_07_Social_Networks.pdf for more.

I think it needs to be noted that many SSA countries suffer from over regulation rather than under-regulation. Onerous rules and bureaucracy hobble the development of many industries through corruption and obstruction and reduce productivity overall by forcing people into the informal sector. The success of M-PESA in Kenya was one of the few instances I can think of where the government and business actually worked together to allow something that would benefit Kenyans widely through increased access to banking services by regular folks and through new opportunities for employment by M-PESA agents.

In Kenya, the Central Bank did initially oppose M-PESA and attempted to stifle it. After discussions with the Central Banks and a full audit of M-PESA by Jospeh Kinyua, Permanent Secretary to the Ministry of Finance, the Central Bank came to see M-PESA as stable and beneficial to Kenya’s banking sector as a whole.

One of the real benefits to M-PESA is that African governments can now tax transactions, where they couldn’t before, Part of the service fees for withdrawals on M-PESA goes to the government.

Also, EcoBank, Equity Bank and Barclays all signed up to work with M-PESA to facilitate better links between small buisinesses where those customers were out of reach before.

I think that, rather than ‘lack of regulation,’ in Kenya’s case, the ability for M-PESA to function was the result of a reasoned debate, at least in Kenya’s case. I can’t speak to other countries.

RT @FrontlineSMS: Why is mobile money so prevalent in Africa? Via @cblatts http://t.co/Et3EXHxgqu cc @fsmscredit

Infographic of distribution of #mobilemoney worldwide. @cblatts asks: why so prevalent in Africa? http://t.co/ImtkX6R22G

@cblatts also because low cost + reach + speed, and accessible technology http://t.co/M4WRrshCYq (2)

@cblatts mobile money prevalent because Africa cannot afford to do it the way we do it here. Too expensive. http://t.co/0eSfq849mO (1)

RT @FrontlineSMS: Why is mobile money so prevalent in Africa? Via @cblatts http://t.co/Et3EXHxgqu cc @fsmscredit

RT @FrontlineSMS: Why is mobile money so prevalent in Africa? Via @cblatts http://t.co/Et3EXHxgqu cc @fsmscredit

Why is mobile money so prevalent in Africa? Via @cblatts http://t.co/Et3EXHxgqu cc @fsmscredit

The distribution of mobile banking/money worldwide http://t.co/sSqJ6dVMkx via @cblatts

RT @cblatts: The distribution of mobile banking/money worldwide http://t.co/4rsF61puaT

“Why is mobile money so prevalent in Africa?” http://t.co/EgSswMTkAe

Why is mobile money so prevalent in Africa? http://t.co/FwchvTADpI via @jetpack

Why is mobile money so prevalent in Africa?: Via @prepaid_africa, this graph on the prevalence of mobile money… http://t.co/kWCJA5YZvD

Interesting map of global mobile money prevalence via @cblatts http://t.co/uUM65durFu Looks roughly like financial exclusion did 15 yrs ago?

Prevalence of mobile money in Africa (via @cblatts): http://t.co/gUlb0AU3PK

Better and smarter regulations, not less. And don’t think that central banks in the emerging world are any less powerful than in the US. But the lack of developed traditional banking infrastructure is a big factor as well.

Where is #mobilemoney taking hold across the globe? And why is it so prevalent in Africa? http://t.co/J32gX8yvce (HT @cblatts)

Why is mobile money so prevalent in Africa? http://t.co/i5kzHGIqEo via @jetpack

For biz, ability to track pymts & reduce leakage is big plus RT @cblatts: Why is mobile money so prevalent in Africa? http://t.co/2sQtFBrQDV

RT @cblatts: The distribution of mobile banking/money worldwide http://t.co/4rsF61puaT

RT @cblatts: The distribution of mobile banking/money worldwide http://t.co/4rsF61puaT

RT @cblatts: The distribution of mobile banking/money worldwide http://t.co/4rsF61puaT

RT @cblatts: The distribution of mobile banking/money worldwide http://t.co/4rsF61puaT

RT @cblatts: The distribution of mobile banking/money worldwide http://t.co/4rsF61puaT

RT @cblatts: The distribution of mobile banking/money worldwide http://t.co/4rsF61puaT

One of those times when you want to read the comments RT @cblatts: The distribution of mobile banking/money worldwide http://t.co/jnu9Cr8QUL

RT @cblatts: The distribution of mobile banking/money worldwide http://t.co/4rsF61puaT

Thierry and imeconomist have got it right. No bank within 50km of here so send the money by phone to the rural area and family collect it at the mobile phone money agent which is often a local shop. Alternative is go to town which is $6 return. Or get it sent on an envelope on the buses.

Why is mobile money so prevalent in Africa? http://t.co/iAD8FBRUNX via @jetpack

RT @cblatts: The distribution of mobile banking/money worldwide http://t.co/PUfIIAremq //follow the money…

RT @cblatts: The distribution of mobile banking/money worldwide http://t.co/4rsF61puaT

The distribution of mobile banking/money worldwide http://t.co/4rsF61puaT

@cblatts I’d summarize your question to answer “vacuum of legacy infrastructure offering opportunities to leapfrog and innovate”

11. No need of maintaining a minimum balance on mobile ie minimum balance is zero but most savings accounts require a minimum of $5

RT @cblatts: Why is mobile money so prevalent in Africa? http://t.co/DZoLlE0nx2

1. High and flat bank charges e.g in Zimbabwe I pay a minimum of $2 (we use US$) for every withdrawal. Imagine how that affects a farm worker who receives $60/month!

2. Amount of paper work required by banks e.g proof of residence required by banks when 50% + of us leave in communal lands where people have no papers that prove ownership of land and buildings

3. Distance traveled to find a bank. In Zimbabwe where I live, banks are only found in towns and SOME growth points but mobile operators have agents at townships

4. The value of transactions required by banks are high but mobile accepts amounts as low as a dollar.

5. Strong family ties in Africa. I use mobile to send money to my grandmother and extended family members

6. One does just has to have a cellphone and an ID to ”receive” money and does not have to be registered

7. The size of the informal economy: I think 99% of people with bank accounts work in the formal sector. People with no regular income seldom open bank accounts.

8. Add point 1 and 7 to the fact that banks (in Zimbabwe) are not paying interest. If you leave your money in a bank it will be eroded by charges

9. Mobile money has a lot of add-ons e.g buying airtime. I dont have to scratch juice cards

10. This applies in Zimbabwe only (maybe): mobile operators are more liquid than banks because of the liquidity crunch we are facing. You can read on the internet how on Christmas some Zimbanks ran out of cash.

Hello dear all,

as an African native, i think that the reason can be like you said, the absence of banking establishment. More important, the banks which are present in the continent don’t provide appropriate service to poor population. mobile money provide usefull service at least cost like money transfert, payment of water, electricity or telecommunation bill. these service only require some times less than $1 US by operation, and doesn’t require the opening or maintenance fees account, as in conventional banks.

For regulation i don’t really know. but mobile money services are usually managed my Mobile phone enterprises which are regulated by national communication agencies

sorry for my english, i’m french speacking native

RT @cblatts: Why is mobile money so prevalent in Africa? http://t.co/DZoLlE0nx2

RT @cblatts: Why is mobile money so prevalent in Africa? http://t.co/DZoLlE0nx2

RT @cblatts: Why is mobile money so prevalent in Africa? http://t.co/DZoLlE0nx2

Lack of regulation covering mobile money is a big factor. Safaricom started by maintaining a single bank account that all mpesa transfers were reconciled against. It is also worth considering that airtime as a currency predates mobile money by a number of years. The practice of buying airtime and sending the activation code to someone else so they could resell it was around for quite a while before mobile money. Then came formalised airtime transfer services (sambaza et al), and then mobile money.

There isn’t an answer but factors include:

1) Job markets that are heavily concentrated requiring seasonal or permanent migration while leaving most of the family at home

2) Need for frequent small dollar transactions within family and social networks to manage low and volatile incomes

3) Lack of existing account infrastructure that allows at least minimal person-to-person payments

Good question RT @cblatts: Why is mobile money so prevalent in Africa? http://t.co/XI0hMHuxbX

RT @cblatts: Why is mobile money so prevalent in Africa? http://t.co/DZoLlE0nx2

@cblatts Lots of correlation with where there’s no regulation of how data/personal info is used by companies: see http://t.co/HDK7m4qhT7

RT @cblatts: Why is mobile money so prevalent in Africa? http://t.co/DZoLlE0nx2

RT @cblatts: Why is mobile money so prevalent in Africa? http://t.co/DZoLlE0nx2