The World Bank is facing what I think of as a March of Dimes moment. The well-known March of Dimes charity was founded in 1938 with a focus on fighting polio. But after the Salk vaccine was licensed for use in 1955 and polio declined rapidly, the charity did not close up shop. Instead, it shifted its focus first to birth defects, and then to issues of healthy pregnancies and premature births.

A combination of growth in lower-income and middle-income countries around the world and change in their economic development challenges is leading to a similar crisis in the mission of the World Bank.

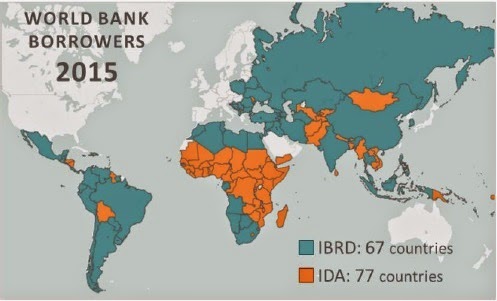

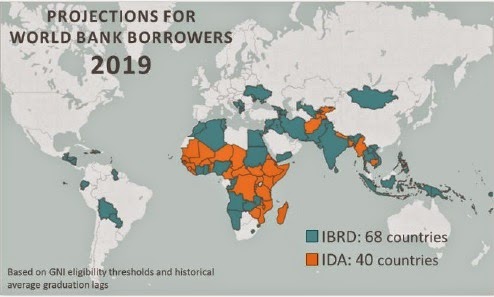

That is Timothy Taylor. He points to these amazing figures from Scott Morris and Madeleine Gleave:

The problem with the countries in orange is that many aren’t growing at all. Some, like the Congo or South Sudan, are conflict-ridden states. Others like Zimbabwe and Uganda have aging autocrats at their helm, and who knows if they’ll manage a change of President without chaos.

The Bank knows this. They’ve produced a steady stream of reports. they’ve reorganized the institution partly around “fragile and conflict-affected states”.

At the same time, you have to worry about an institution that is supposed to apolitical, has a mandate to push money out the door to a smaller and smaller group of countries, and at the same time can only push the money through the central government, thuggish or not. This doesn’t exactly increase the thugs’ incentives to share power.

The Bank is the world’s largest aid donor by a big margin. So it matters.

This is when most bloggers would write the solution. Truth is I don’t know and I don’t know many people who do.

Honestly, a retreat to what the Bank does best–helping get roads and power plants built, and underwriting highly decentralized development programs (cash transfers, school and clinic building, and so on)–might be the safest strategy, given that the pipeline of aid into these places is unlikely to stop pumping. But “try to do as little damage as possible” is not the most inspiring rallying cry.

74 Responses

HT Uma Lele for pointing me to this article. The Bank might have organized better to deal with fragility, conflict and violence. I hope that there’s not been too big a setback under the new unit and its leadership, which has led to seriously disengaged staff.

WB: ‘apolitical…push money out…through the central government’ – could these be advantages as well as a problem? http://t.co/2PjnpychM5

“is supposed to apolitical, has a mandate to push money out the door to a smaller and smaller group of countries, and at the same time can only push the money through the central government, thuggish or not” – each of these things can be an advantage in FCAS environments if harnessed correctly. The first can provide risk cover for other donors, the second and third can be used to create incentives to build some insulated islands of functionality. ARTF in Afghanistan is a case in point.

There is another task, for which the Bank should be uniquely suited, but seems less concerned with: ensuring global public goods are provided, and funded by those who can afford them.

The World Bank has a conflict problem: The World Bank is facing what I think of as a March of Dimes moment. Th… http://t.co/Io2Cad1000

RT @TonysAngle: Coming crisis in the World Bank’s mission: fragile & conflict-affected states (plus ageing autocrats). what to do? http://t…

A point to ponder. The World Bank has a conflict problem http://t.co/ywJKs76UZ2

RT @TonysAngle: Coming crisis in the World Bank’s mission: fragile & conflict-affected states (plus ageing autocrats). what to do? http://t…

RT @alb202: “The World Bank has a conflict problem.” @cblatts put his finger on what may be *the* dev. issue over next 5-10 yrs. http://t.c…

RT @andynortondev: from @cblatts ‘The World Bank has a conflict problem’ (& a governance problem too, not unrelated to th argument here) ht…

RT @andynortondev: from @cblatts ‘The World Bank has a conflict problem’ (& a governance problem too, not unrelated to th argument here) ht…

RT @TonysAngle: Coming crisis in the World Bank’s mission: fragile & conflict-affected states (plus ageing autocrats). what to do? http://t…

RT @TonysAngle: Coming crisis in the World Bank’s mission: fragile & conflict-affected states (plus ageing autocrats). what to do? http://t…

Coming crisis in the World Bank’s mission: fragile & conflict-affected states (plus ageing autocrats). what to do? http://t.co/C8whjtGTjB

RT @andynortondev: from @cblatts ‘The World Bank has a conflict problem’ (& a governance problem too, not unrelated to th argument here) ht…

RT @IlonaKickbusch: The World Bank – Another global Institution with Problems? #globalgovernance http://t.co/KptE2BGzBD

The World Bank has a conflict problem http://t.co/IVYJGmCwB2

from @cblatts ‘The World Bank has a conflict problem’ (& a governance problem too, not unrelated to th argument here) http://t.co/vbQY7MxNNC

RT @SAISAfrica: The World Bank has a conflict problem http://t.co/Xo9FBFRYF7

Does the World Bank have a problem? http://t.co/AriZzqXGvy

Who will be borrowing from the World Bank in 2019? http://t.co/sEe4BLSnwE

The World Bank has a conflict problem http://t.co/Xo9FBFRYF7

RT @cblatts: The development challenge of our time: How soon before most aid is going just to politically unstable states? http://t.co/kSqa…

RT @cblatts: The World Bank has a conflict problem http://t.co/yKI9jpY5OR

RT @ErolYayboke: The World Bank has a conflict problem http://t.co/YkwFlBs1Al via @cblatts

RT @ErolYayboke: The World Bank has a conflict problem http://t.co/YkwFlBs1Al via @cblatts

The World Bank has a conflict problem http://t.co/YkwFlBs1Al via @cblatts

RT @D_Wlkr: The World Bank has a ‘conflict’ problem http://t.co/CVbqbzHILh @SLRCtweet @WorldBankAfrica @WorldBank http://t.co/R1Z2bABSbg

RT @sunil_suri: @cblatts ‘The @WorldBank has a conflict problem’: http://t.co/vNta6G7X5J @TJAWheeler @Anna_Loswick

The World Bank has a conflict problem – Chris Blattman – http://t.co/dXjFpPiZhr

RT @D_Wlkr: The World Bank has a ‘conflict’ problem http://t.co/CVbqbzHILh @SLRCtweet @WorldBankAfrica @WorldBank http://t.co/R1Z2bABSbg

The World Bank has a ‘conflict’ problem http://t.co/CVbqbzHILh @SLRCtweet @WorldBankAfrica @WorldBank http://t.co/R1Z2bABSbg

The #WorldBank has a #conflict problem but ‘do as little damage as possible’ ≠ rallying cry by @cblatts http://t.co/de5xZqr4vM

The World Bank has a conflict problem http://t.co/GZ64aVHDYt

The World Bank has a conflict problem — Chris Blattman — http://t.co/lJcdOPHP0R

.@cblatts’s post about the WB’s shrinking service area gets to the crux of a problem some people have with dev banks http://t.co/oFpShmFdpc

@cblatts The World Bank has a conflict problem h/t @TimothyTTaylor http://t.co/U7NX19zhK8

RT @WilHMoo: The World Bank has a conflict problem

http://t.co/Pd7qRSawci

The World Bank has a conflict problem

http://t.co/Pd7qRSawci

@Ciscogiii re our convo http://t.co/TTZxfIJ9II

RT @cblatts: The World Bank has a conflict problem http://t.co/yKI9jpY5OR

RT @sunil_suri: @cblatts ‘The @WorldBank has a conflict problem’: http://t.co/vNta6G7X5J @TJAWheeler @Anna_Loswick

RT @cblatts: The World Bank has a conflict problem http://t.co/yKI9jpY5OR

RT @cblatts: The World Bank has a conflict problem http://t.co/yKI9jpY5OR

RT @cblatts: The development challenge of our time: How soon before most aid is going just to politically unstable states? http://t.co/kSqa…

RT @cblatts: The development challenge of our time: How soon before most aid is going just to politically unstable states? http://t.co/kSqa…

RT @cblatts: The development challenge of our time: How soon before most aid is going just to politically unstable states? http://t.co/kSqa…

Worth reading from @cblatts: http://t.co/bdXtmTtxZy on the future of World Bank lending

RT @alb202: “The World Bank has a conflict problem.” @cblatts put his finger on what may be *the* dev. issue over next 5-10 yrs. http://t.c…

RT @cblatts: The development challenge of our time: How soon before most aid is going just to politically unstable states? http://t.co/kSqa…

Interesting look at the future of the World Bank http://t.co/ctgc3jmbfg

“The World Bank has a conflict problem.” @cblatts put his finger on what may be *the* dev. issue over next 5-10 yrs. http://t.co/mHgzz9d2Tu

RT @AndaM_D: The World Bank has a conflict problem http://t.co/UL0XlvzzXI

RT @cblatts: The development challenge of our time: How soon before most aid is going just to politically unstable states? http://t.co/kSqa…

RT @cblatts: The development challenge of our time: How soon before most aid is going just to politically unstable states? http://t.co/kSqa…

RT @cblatts: The development challenge of our time: How soon before most aid is going just to politically unstable states? http://t.co/kSqa…

Yep RT The World Bank has a conflict problem http://t.co/hAiqcd0nVC

RT @cblatts: The World Bank has a conflict problem http://t.co/yKI9jpY5OR

The World Bank has a conflict problem: http://t.co/jHLHxbL6s7 by @cblatts Other donors probably, too, especially if they follow WB lead

The World Bank has a conflict problem http://t.co/UL0XlvzzXI

RT @cblatts: The World Bank has a conflict problem http://t.co/yKI9jpY5OR

The World Bank has a conflict problem http://t.co/BHFyOwqrcY

RT @cblatts: The World Bank has a conflict problem http://t.co/yKI9jpY5OR

RT @cblatts: The World Bank has a conflict problem http://t.co/yKI9jpY5OR

@cblatts ‘The @WorldBank has a conflict problem’: http://t.co/vNta6G7X5J @TJAWheeler @Anna_Loswick

The World Bank has a conflict problem http://t.co/TjayXeqWaN via @Digg

RT @l_haddad: The World Bank has a conflict problem http://t.co/lFk1nxqccy

RT @cblatts: The World Bank has a conflict problem http://t.co/yKI9jpY5OR

The World Bank has a conflict problem http://t.co/lFk1nxqccy

RT @cblatts: The World Bank has a conflict problem http://t.co/yKI9jpY5OR

RT @cblatts: The World Bank has a conflict problem http://t.co/yKI9jpY5OR

RT @cblatts: The World Bank has a conflict problem http://t.co/yKI9jpY5OR

RT @cblatts: The World Bank has a conflict problem http://t.co/yKI9jpY5OR

RT @cblatts: The World Bank has a conflict problem http://t.co/yKI9jpY5OR